san francisco sales tax rate history

The use tax was enacted effective July 1 1935. The California sales tax rate is currently.

2022 Property Taxes By State Report Propertyshark

The December 2020 total local sales tax rate was 8500.

. The current total local sales tax rate in South San Francisco CA is 9875. This is the total of state county and city sales tax rates. For more information on district taxes please see CDTFA-105 District.

The minimum combined 2022 sales tax rate for San Francisco California is. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. 21 rows Sales tax only.

Most of these tax changes were. This includes the rates on the state county city and special levels. The December 2020 total local sales tax rate was 9750.

Rates have not changed since FY 1993-94. What is the sales tax rate in San Francisco California. The South San Francisco Puerto Rico sales tax rate of 9875 applies to the following two zip codes.

Has impacted many state nexus laws and sales tax collection. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable.

Rates are for total sales tax levied in the City County of San Francisco. The 94112 San Francisco California general sales tax rate is 85. Effective 7111 rates are 286 per Individual Line.

5 Access Line Tax. The new rates will be. 2148 per Trunk Line 6 Real Property Transfer Tax.

This is the total of state county and city sales tax. Notes to Rate History Table. The rates above exclude district taxes.

An alternative sales tax rate of 9875 applies in the tax region Daly. The progressive tax rate ranges between 01 to 06 and is assessed on gross receipts sourced to San Francisco as determined for Gross Receipts Tax purposes. The current total local sales tax rate in San Francisco CA is 8625.

4 Utility Users Tax. San Francisco has parts of it located within. South San Francisco CA Sales Tax Rate.

The transfer tax rate had been previously unchanged since 1967. The current total local sales tax rate in San Francisco County CA is 8625. The 2018 United States Supreme Court decision in South Dakota v.

In San Francisco the tax rate will rise from 85 to 8625. The local sales tax rate in San Francisco Puerto Rico is 8625 as of September 2022. The median property tax in San Francisco County California is 4311 per year for a home worth the median value of 785200.

The December 2020 total local sales tax rate was 8500. 94080 and 94083. San Francisco County collects on average 055.

The estimated 2022 sales tax rate for 94107 is. The average cumulative sales tax rate in San Francisco California is 864. San Francisco County CA Sales Tax Rate.

Historical Tax Rates in California Cities Counties. San Francisco CA Sales Tax Rate. 1788 rows San Francisco 8625.

The minimum combined 2022 sales tax rate for San Francisco California is 863. San Mateo 900 Houston 825 Mountain View 900 Las Vegas 825 Palo Alto 900 Larkspur Measure B 025 Approved November 2017 ballot Atlanta 890 Santa Clara 900. The Sales and Use tax is rising across California including in San Francisco County.

0875 lower than the maximum sales tax in CA.

Understanding California S Sales Tax

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Opinion Why California Worries Conservatives The New York Times

California Sales Tax Rates By City County 2022

California City County Sales Use Tax Rates

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Understanding California S Sales Tax

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Understanding California S Sales Tax

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Frequently Asked Questions City Of Redwood City

Understanding California S Sales Tax

How Do State And Local Sales Taxes Work Tax Policy Center

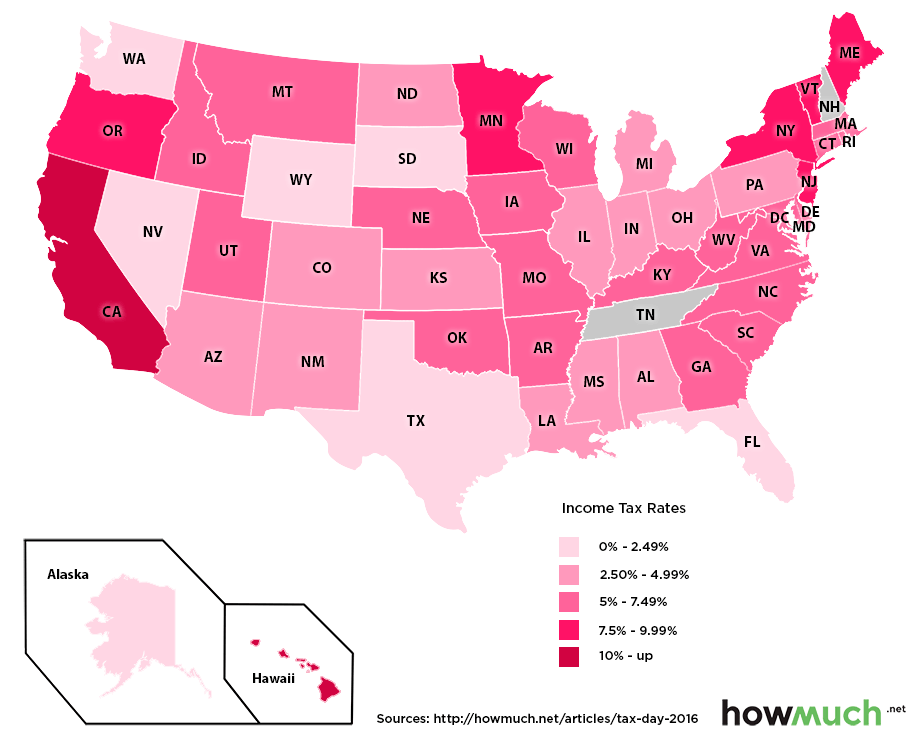

Which U S States Have The Lowest Income Taxes

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Understanding California S Sales Tax

How Do State And Local Sales Taxes Work Tax Policy Center

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada